Schedule C Irs 2024 – There are other tax changes happening next year that could put more money in your paycheck. If you collect Social Security, you’ll receive a 3.2% cost-of-living-adjustment in 2024. And since the first . US Self-Employment Tax 2023: It is common for self-employed people to have more freedom and control over their profession or business. It also implies that they can no longer rely on their employer to .

Schedule C Irs 2024

Source : carta.com

Budgets 2 Goals | Baton Rouge LA

Source : www.facebook.com

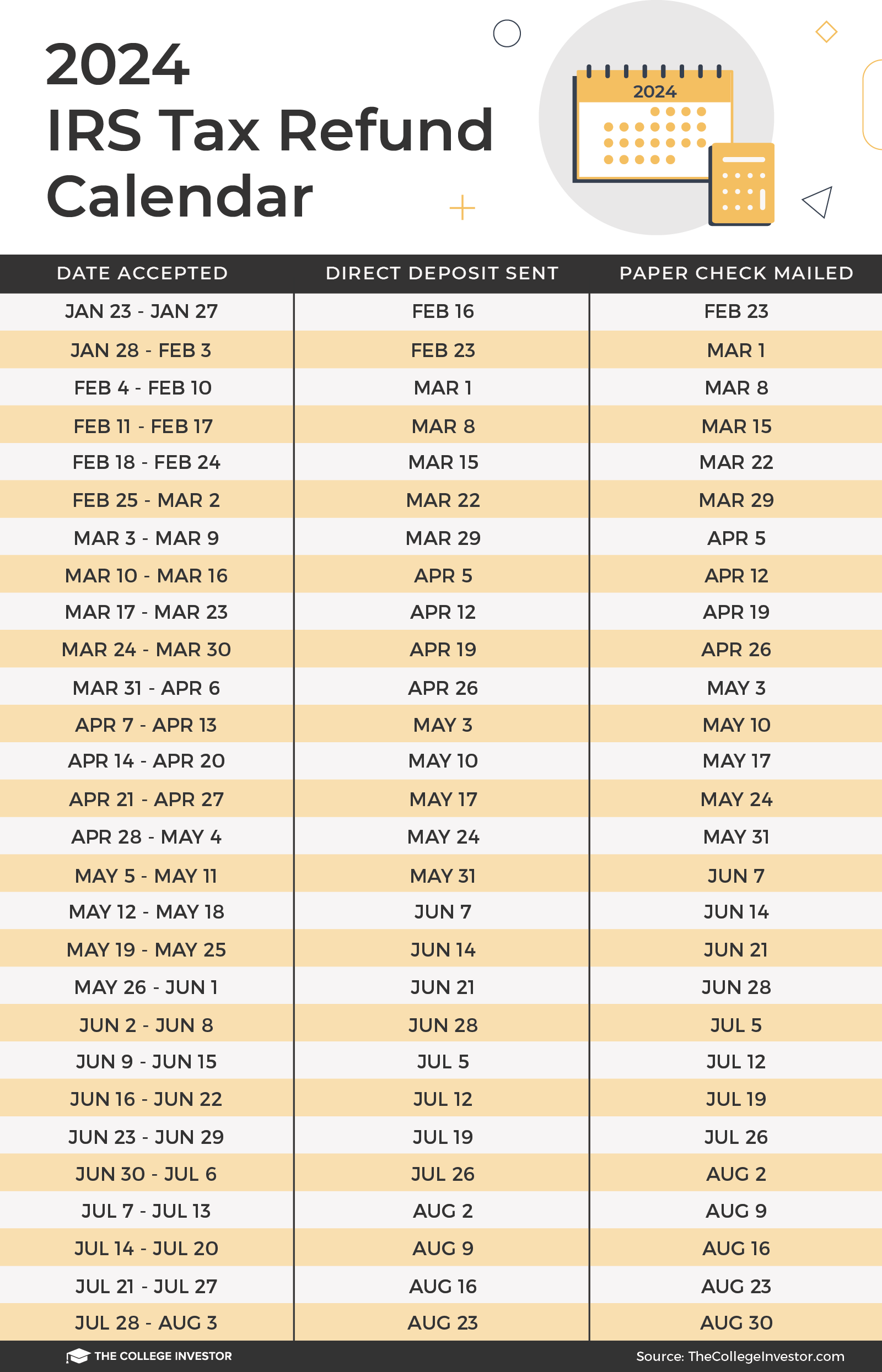

When To Expect My Tax Refund? The IRS Tax Refund Calendar 2024

Source : thecollegeinvestor.com

Safe Harbor Bookkeeping DFW

Source : www.facebook.com

Property Management Tax Reporting Made Easy | Buildium

Source : www.buildium.com

Here’s who qualifies for IRS’ free ‘Direct File’ pilot program in 2024

Source : www.cnbc.com

2023.11.30 Broadcast LAST CHANCE for In Person Classroom

Source : drakesoftware.com

M & J Services | La Villa TX

Source : www.facebook.com

Key IRS Updates for 2024: Health Savings Accounts, High Deductible

Source : cosmoins.com

FACTS Flyer 2023 2024 Padua Franciscan High School

Source : paduafranciscan.com

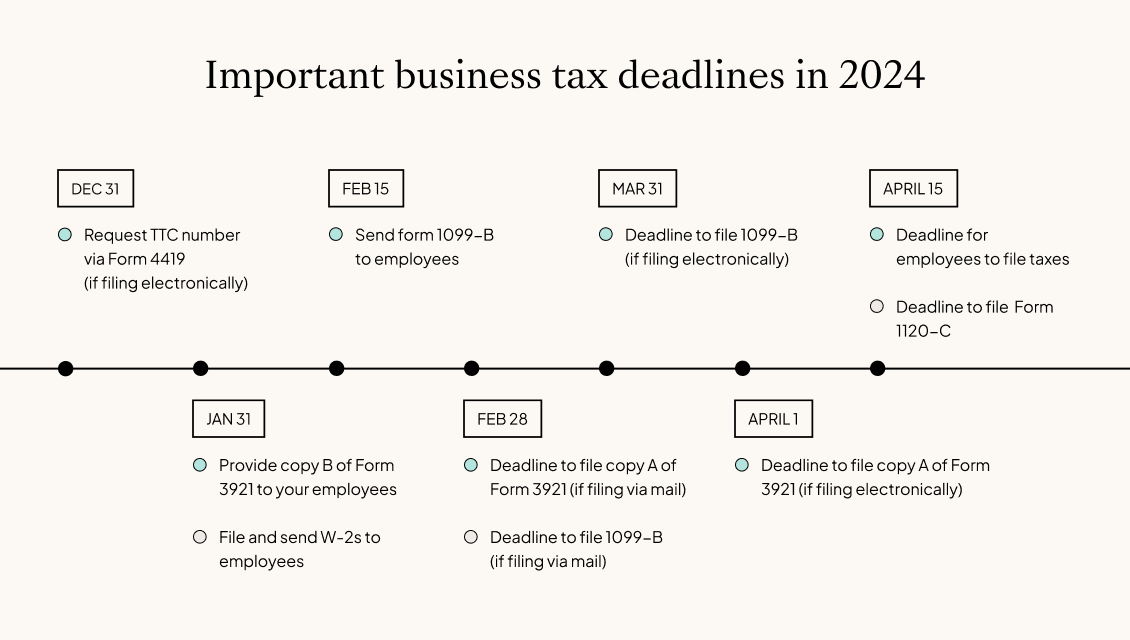

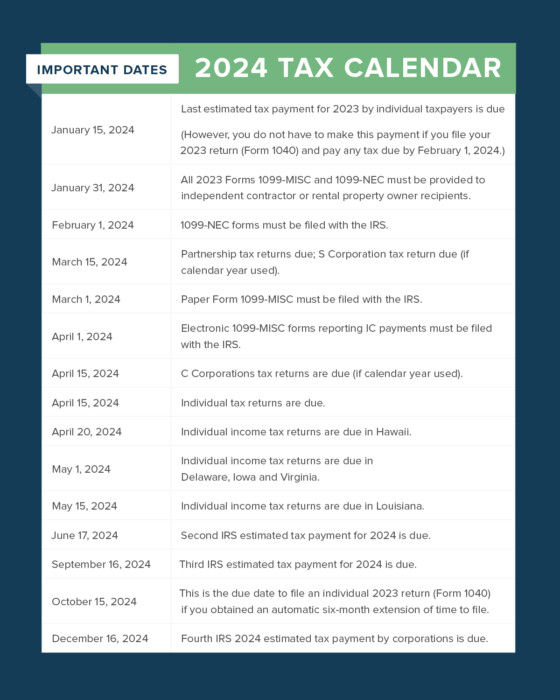

Schedule C Irs 2024 Business tax deadlines 2024: Corporations and LLCs | Carta: The Internal Revenue Service has announced that income tax brackets and standard deductions will be changing come the 2024-2025 season. The IRS released the information Thursday in its annual . Schedule C: Profit or Loss from Business is an Internal Revenue Service (IRS) tax form that is used to report income and expenses for a business. Schedule C must accompany Form 1040, which is a .